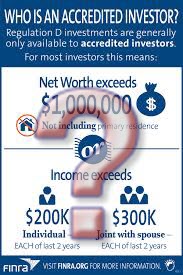

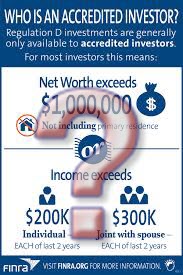

Securities offerings that are exempt from the SEC’s registration requirements often hinge on whether some or all of the investors are “accredited investors.” There are various categories of accredited investors for business entities, but for individuals, the categories relate to the investor’s annual income, net worth or whether the individual is a director or executive officer of the issuer.

Securities offerings that are exempt from the SEC’s registration requirements often hinge on whether some or all of the investors are “accredited investors.” There are various categories of accredited investors for business entities, but for individuals, the categories relate to the investor’s annual income, net worth or whether the individual is a director or executive officer of the issuer.

The underlying policy of the current definition of accredited investors is that rich people (a term not used in the actual rules, obviously) can be assumed to have a level of financial sophistication such that they would conduct adequate due diligence before making an investment. Accordingly, accredited investors require less disclosure about proposed securities offerings. This assumption is, shall we say, not attuned to human reality. The obvious group of accredited investors that are not necessarily sophisticated is heirs and spouses of wealthy business people, who may have no background at all in finance and investment matters. But even for those accredited investors who have directly earned the money that grants them that status, plenty are in fields such as sports and entertainment where the particular skill that is remunerative to them has nothing to do with investing. Additionally, many white collar professionals such as doctors, engineers and even some attorneys may be highly educated, but they are not able to make heads or tails of a balance sheet and income statement. …

A Possible Change to the “Accredited Investor” DefinitionRead More »

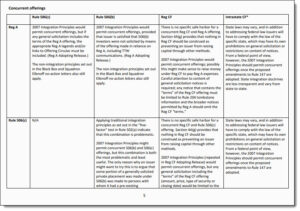

Back when the equity crowdfunding rules were proposed following passage of the JOBS Act, the $1 million offering limit per year for what are now known as Regulation CF offerings was viewed as making this procedure impractical. The amount raised would not be sufficient in light of the legal, accounting and other costs needed to prepare for the offering. However, as crowdfunding is now a reality and companies are giving it a shot, a fix to the dollar limit has evolved: raise funds not just under Regulation CF, but under other exemptions that are not subject to that dollar limit.

Back when the equity crowdfunding rules were proposed following passage of the JOBS Act, the $1 million offering limit per year for what are now known as Regulation CF offerings was viewed as making this procedure impractical. The amount raised would not be sufficient in light of the legal, accounting and other costs needed to prepare for the offering. However, as crowdfunding is now a reality and companies are giving it a shot, a fix to the dollar limit has evolved: raise funds not just under Regulation CF, but under other exemptions that are not subject to that dollar limit. A year or two ago, the phrase “share buybacks” was a phrase only known to those in and around the world of corporate finance. It refers to a company’s use of available cash to purchase its own shares in the open market. The effect of this is to reduce the total number of shares outstanding, which makes the remaining shares more valuable. Recently, however, share buybacks have become enmeshed in political debates as shorthand for actions taken by corporate America and encouraged by Wall Street that are not in the best interest of workers and society generally. For example, The New York Times recently reported on how

A year or two ago, the phrase “share buybacks” was a phrase only known to those in and around the world of corporate finance. It refers to a company’s use of available cash to purchase its own shares in the open market. The effect of this is to reduce the total number of shares outstanding, which makes the remaining shares more valuable. Recently, however, share buybacks have become enmeshed in political debates as shorthand for actions taken by corporate America and encouraged by Wall Street that are not in the best interest of workers and society generally. For example, The New York Times recently reported on how  Matt Levine, writing in Bloomberg View,

Matt Levine, writing in Bloomberg View,  In the past few years, my private company clients have been flocking to online, cloud-based cap table services, such as

In the past few years, my private company clients have been flocking to online, cloud-based cap table services, such as  President Trump’s inimitable personal attorney, Michael Cohen, was reported by the Wall Street Journal to have

President Trump’s inimitable personal attorney, Michael Cohen, was reported by the Wall Street Journal to have  I read with interest an essay in the Wall Street Journal by a management professor, Morten T. Hansen, arguing that

I read with interest an essay in the Wall Street Journal by a management professor, Morten T. Hansen, arguing that

Securities offerings that are exempt from the SEC’s registration requirements often hinge on whether some or all of the investors are “

Securities offerings that are exempt from the SEC’s registration requirements often hinge on whether some or all of the investors are “

My wife, Leslie, pursued an entrepreneurial venture mid-career like me, founding

My wife, Leslie, pursued an entrepreneurial venture mid-career like me, founding