Back when the equity crowdfunding rules were proposed following passage of the JOBS Act, the $1 million offering limit per year for what are now known as Regulation CF offerings was viewed as making this procedure impractical. The amount raised would not be sufficient in light of the legal, accounting and other costs needed to prepare for the offering. However, as crowdfunding is now a reality and companies are giving it a shot, a fix to the dollar limit has evolved: raise funds not just under Regulation CF, but under other exemptions that are not subject to that dollar limit.

Back when the equity crowdfunding rules were proposed following passage of the JOBS Act, the $1 million offering limit per year for what are now known as Regulation CF offerings was viewed as making this procedure impractical. The amount raised would not be sufficient in light of the legal, accounting and other costs needed to prepare for the offering. However, as crowdfunding is now a reality and companies are giving it a shot, a fix to the dollar limit has evolved: raise funds not just under Regulation CF, but under other exemptions that are not subject to that dollar limit.

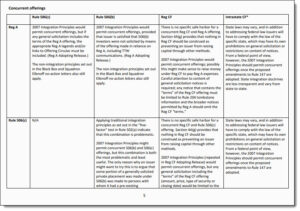

One might think that a way to do this would be to conduct a traditional private placement under Rule 506(b), which has no dollar limit, alongside the Regulation CF offering. However, this is a poor fit because of so-called “integration” issues. Regulation CF permits general solicitation, subject to limits, while Rule 506(b) by definition prohibits the “blast-it-out” approach, so efforts to spread the word on the Regulation CF offering could be deemed to be improper promotion of the Rule 506(b) offering.

A better fit would be another exemption arising out of the JOBS Act: a Rule 506(c) offering to all accredited investors, with no dollar limitation, which can be offered through the same portals that are required for Regulation CF offerings. Because general solicitation is permitted under both exemptions, there is not the same integration issue as with Rule 506(b). By combining Regulation CF and Rule 506(c) in an offering via a web portal, companies can raise essentially any amount needed. The portal would steer non-accredited investors to the Regulation CF bucket, and accredited investors would invest under Rule 506(c). This allows companies to allow for small increment investments in situations where it doesn’t want to limit its shareholder base to accredited investors, while not being constrained meaningfully by the offering dollar limit. (In fact, a client of mine just successfully completed an offering in this manner.)

When conducting simultaneous offerings like this, companies do need to pay attention to the respective rules for each exemption, particularly the restrictions on communications by companies outside the portal during a Regulation CF offering. These rules do not apply to Rule 506(c), but companies need to be advised on conducting themselves appropriately when dealing with all investors. CrowdCheck prepared this handy-dandy series of tables summarizing various combinations of offering exemptions and issues to consider when pursuing them.