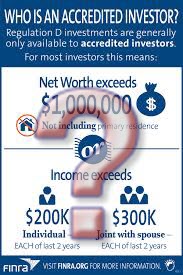

Securities offerings that are exempt from the SEC’s registration requirements often hinge on whether some or all of the investors are “accredited investors.” There are various categories of accredited investors for business entities, but for individuals, the categories relate to the investor’s annual income, net worth or whether the individual is a director or executive officer of the issuer.

Securities offerings that are exempt from the SEC’s registration requirements often hinge on whether some or all of the investors are “accredited investors.” There are various categories of accredited investors for business entities, but for individuals, the categories relate to the investor’s annual income, net worth or whether the individual is a director or executive officer of the issuer.

The underlying policy of the current definition of accredited investors is that rich people (a term not used in the actual rules, obviously) can be assumed to have a level of financial sophistication such that they would conduct adequate due diligence before making an investment. Accordingly, accredited investors require less disclosure about proposed securities offerings. This assumption is, shall we say, not attuned to human reality. The obvious group of accredited investors that are not necessarily sophisticated is heirs and spouses of wealthy business people, who may have no background at all in finance and investment matters. But even for those accredited investors who have directly earned the money that grants them that status, plenty are in fields such as sports and entertainment where the particular skill that is remunerative to them has nothing to do with investing. Additionally, many white collar professionals such as doctors, engineers and even some attorneys may be highly educated, but they are not able to make heads or tails of a balance sheet and income statement.

The House of Representatives recently passed the Fair Investment Opportunities for Professional Experts Act, which, if enacted, would maintain the current categories of accredited investors for individuals, but would add as separate categories licensed financial services professionals and other individuals determined by SEC regulation to have appropriate education or experience. This is a step in the right direction, as it turns the focus to the investor’s actual demonstrated sophistication in these matters. However, by leaving the income and net worth categories in place as well, the rules still would not adequately act as a reasonable proxy for knowledge in investing matters.