Keith F. Higgins, the Director of the Division of Corporation Finance at the SEC, recently spoke at the 2014 Angel Capital Association Summit. His speech came in the midst of much JOBS Act rulemaking that I’ve blogged about frequently, and his remarks provide some useful insight into what the SEC is thinking about these days, although he includes the standard disclaimer that he’s speaking for himself and not the whole agency. In particular, I thought the following topics that he covered were worthy of note:

Regarding the new rules permitting general solicitation for all-accredited investor offerings, he cites statistics showing that the frequency of such offerings has been surprisingly small since the rules went into effect and assesses some possible reasons why.

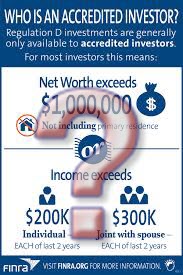

Regarding the new rules permitting general solicitation for all-accredited investor offerings, he cites statistics showing that the frequency of such offerings has been surprisingly small since the rules went into effect and assesses some possible reasons why.- One of those possible reasons is confusion about the obligation to verify accredited investor status, which he notes is a principles-based inquiry. Much commentary about the rules seems to imply that providing the issuer with tax returns or brokerage statements is required, but he correctly points out that a principles-based system does not prescribe a single means of compliance. I’m supportive of principles-based rulemaking, but many practitioners are uncomfortable when advising on non-bright line rules and therefore provide overly conservative advice that does not reflect the SEC’s intent. Higgins also notes in passing that the SEC expects a role for third party verification of accredited investor status. I think this is the key point that should eliminate any sensitivity among investors who need to provide personal information.

- He notes an “overhang” of the proposed Regulation D/Form D amendments, where there is a misplaced concern that rules that have not yet been enacted will be retroactively applied to offerings taking place now.

- He describes efforts being taken by the SEC to revisit the accredited investor definition, possibly using factors other than income and net worth in the determination, which would be welcome. As I’ve noted, income and net worth are often poor proxies for investment sophistication.